SMB Financial HUB

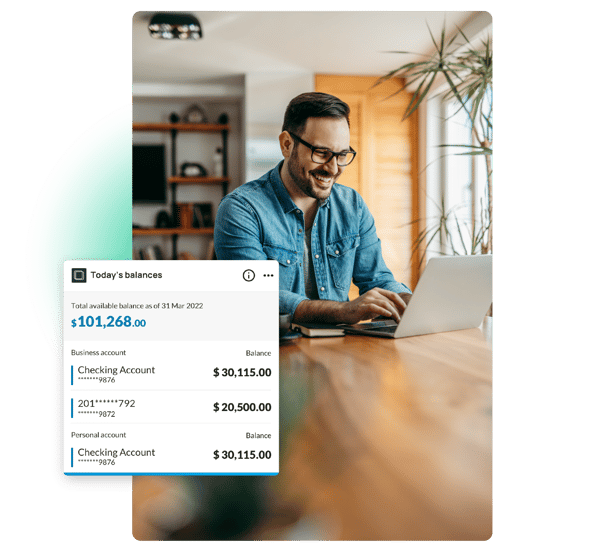

Transform Financial Oversight with 9Spokes Banking Feature

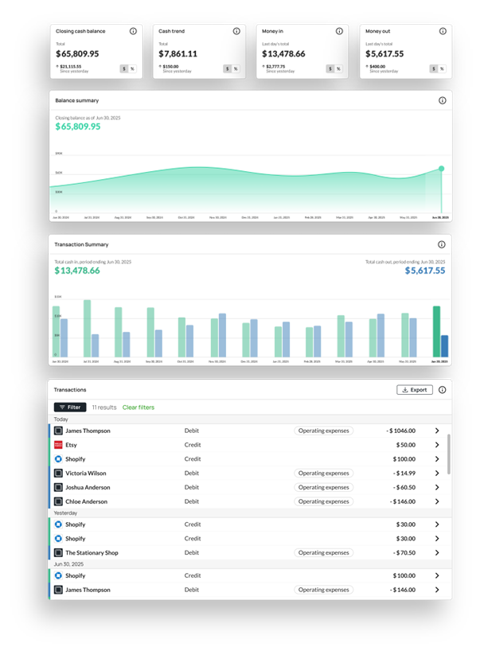

Understanding spending, trends, and Cashflow at a Glance

Leveraging open banking, 9Spokes' banking feature consolidates historical data from multiple accounts into an intuitive view, empowering SMBs with a unified view of their finances and actionable insights enriched by third-party data.

9Spokes cash management insights empower SMBs to evaluate money in/money out, enabling critical business decisions with ease.

What Banking provides SMBs

-

Gain a clear overview of their current financial status for quick and informed understanding.

-

Track changes in cash balances and spending habits over time using simple, intuitive graphs.

-

Identify the largest sources of income and expenses to prioritize financial strategies.

-

Explore specific transactions in depth to enhance confidence in decision-making