Drive Growth in Your Teams and Their Customers

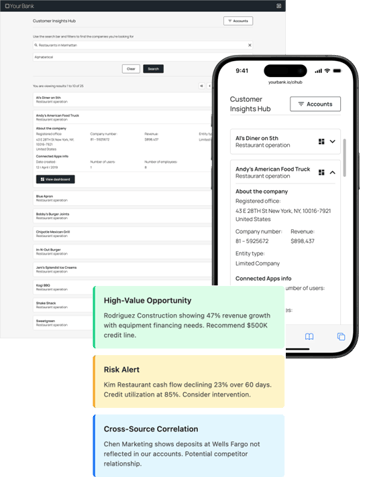

Powering Institutional Tech Stacks: 9Spokes Customer Insight Hub

Analyzing the vast insights on our 9Spokes' SMB Financial Hub, the 9Spokes' Customer Insight Hub consolidates data into rich insights for financial service providers' technology stack and the teams that need them to run, grow, and improve your book of business.

How our Customer Insights Hub supports you to grow your Small Business book of business

-

Save time reviewing current cash position and business performance for your small business clients

-

Quick overview on working capital with their relationship manager

-

Deeper share of wallet insights with broad open banking and data connections for faster lending conversations

-

Hyper personalized insights and product suggestions on company position and trends

-

Identify priority areas for bank conversations on cashflow, credit or lending opportunities, and long-term growth planning

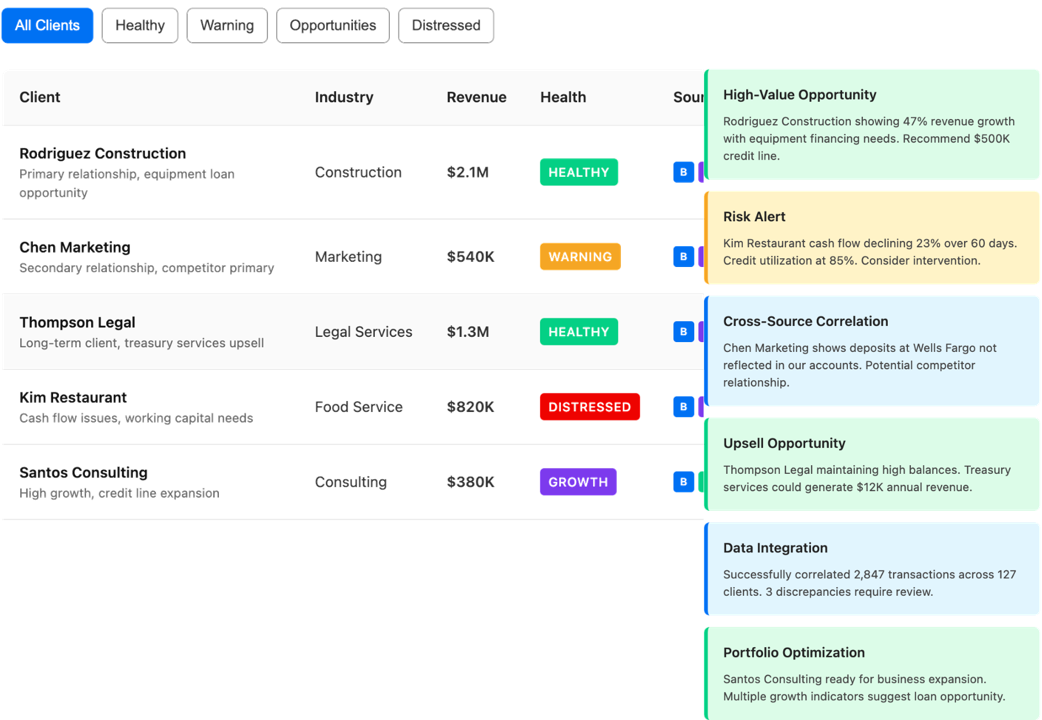

How our Insights Hub helps Financial Services Providers and their teams

-

Holistic financial views into each business client

-

Determine portfolio risk or opportunity for lines of credit

-

Broaden business banking customer strategies based on industry, location, or size of company

-

Widen share of wallet view to other internal banking teams (credit risk, lending, underwriting, etc)

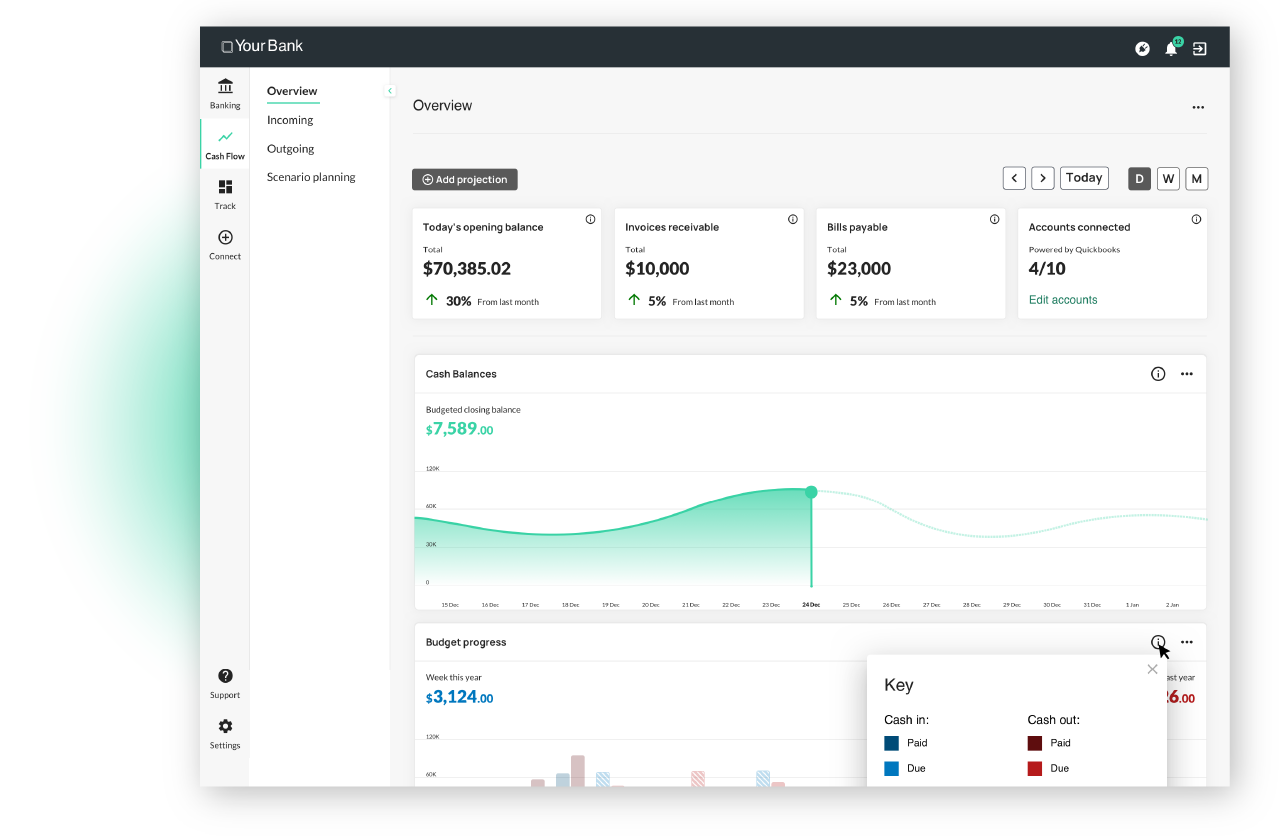

Cashflow

Help your customers to manage their cash flow by connecting their general ledger data. Small businesses can:

-

Understand current cash position based on banking and general ledger data.

-

See cashflow against a budget set.

-

View transactions impacting cashflow position.

-

Use Kanban or calendar view to change the due date for bills and invoice to evaluate the impact on cashflow position.

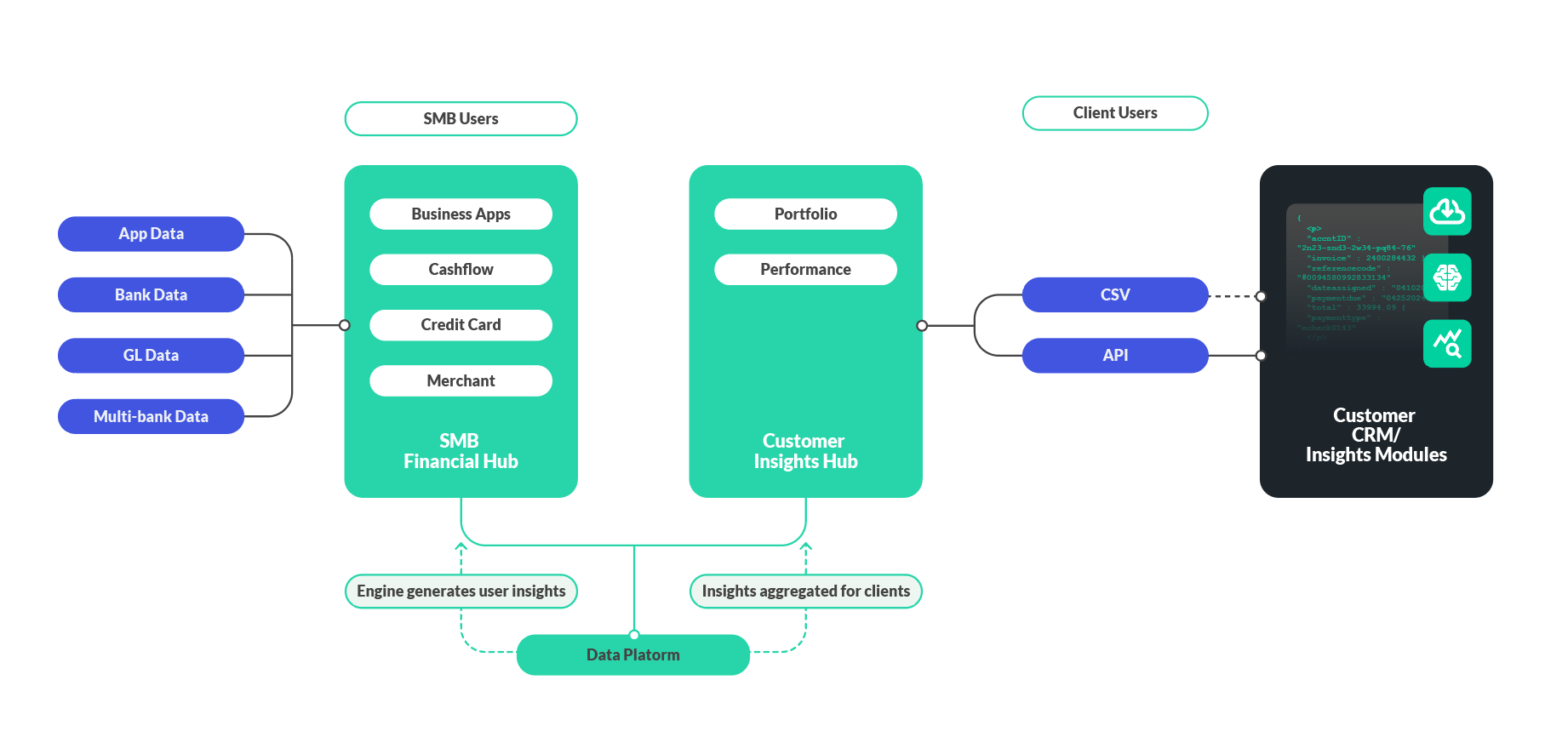

HOW WE DO IT

Connect our aggregated data and insights into any platform

Integrating with your existing technology stack and processes, the 9Spokes platform can enrich data from your Customer Relationship Management (CRM), Business Intelligence (BI), loan origination systems (LOS), internal AI agents (MCPs), and your core banking platform to better understand your SMB customers, improve efficiency and reduce risk upon your current technology stack.

INSIGHTS FOR INTERNAL SHAREHOLDERS

Unlocking Data, Strengthening Relationships, Delivering Value

Our small business insights are built for all teams. Take a look at how our data empowers your company at all levels

GROWTH INSIGHTS

Faster assessment and personalized financial advice for business client needs by evaluating liquidity, cashflow, profitability, and other financial measurements for success. Determine financial solutions from basic accounts or more complex lending products based on customer's business and financial standing.

Insights for building stronger relationships with current small business clients, understanding their needs, and acting as a trusted financial advisor. Review localized and industry-specific for more targeted community engagement for local business associations, chambers of commerce, and networking events to build upon relationships and further establish the Financial Service Provider as a supportive partner in the small business community.

DIGITAL INSIGHTS

Identify unique opportunities to cross-sell other financial services products and services that could benefit the small business, such as business credit cards, lending opportunities, retirement plans, or wealth management services for the owner and promote on our SMB Financial Hub's homeboard for better awareness on how your company can help.

Reduce time and effort in developing digital solutions with our SMB Financial platform connecting banking, cashflow, merchant, and business application data and strategies directly into our Customer Insights Hub and your broader tech stack. Implementing our holistic platform allows for more time to focus on customer retention, streamlining processes, and identifying additional external data solutions relevant for your company goals.

OPERATIONS INSIGHTS

Consented and real-time, our Customer Insight Hub provides share of wallet, cashflow, type of credit, and business readiness details directly to credit analysts to assess the creditworthiness of loan applicants, evaluating financial position, and mitigating risk to your company.

Evaluate both performance and portfolio insights for gaps in customer enablement and financial education to reduce and refine customer service workflows or inquiries. Our Customer Insight Hub can provide the visibility necessary when customer service teams need to coordinate with other bank departments to ensure that clients receive timely and effective support.

The 9Spokes Customer Insight Hub supports underwriting processes with faster time to review necessary financial and business accounts, cashflow position, accounts payable/receivables, creditworthiness, and other relevant data points that are in the small business owner's SMB Financial Hub.

READY TO GET STARTED?

We aim to empower businesses with secure, reliable data solutions that deliver essential insights and tools, driving growth and success for both them and their business customers. Contact our team to discover how 9Spokes can support your goals.