Empower Your Customer’s Experience with Smart Data-Driven Insights

White-label analytics platform with data-driven insights for smarter decisions and stronger relationships. Empower your financial institution as the trusted hub for customers to gain insights and drive success.

THE 9SPOKES PLATFORM

Delivering Value and Insights to your SMB Customer

9Spokes is an industry-leading data platform that transforms complex data into actionable insights, empowering banks, financial institutions, and fintechs to enhance their SMB customer relationships.

With flexible access to aggregated business data, the platform enables institutions to refine service offerings and drive growth through tailored strategies. This enables financial institutions to provide their customers with advanced tools to manage their financial operations effectively, driving better outcomes for both parties.

SMB FINANCIAL HUB

Unify Your Business, Amplify Your Growth

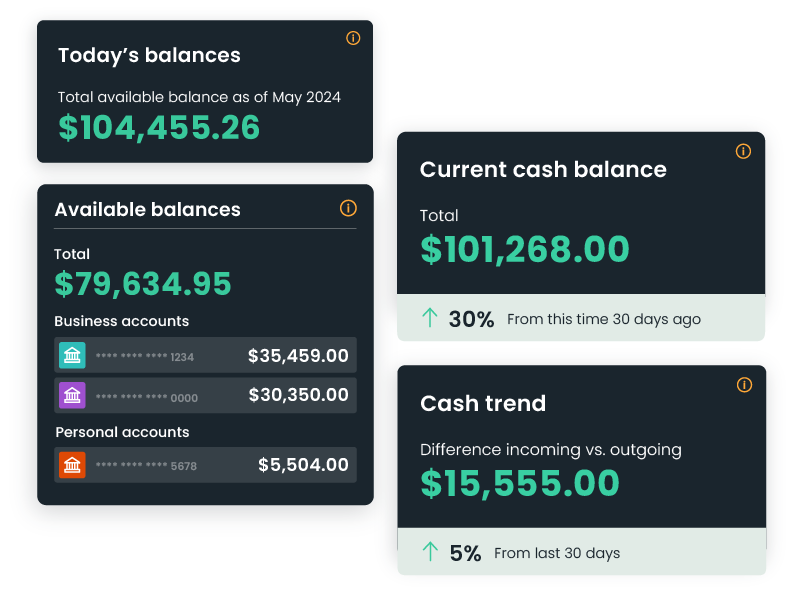

The SMB Financial Hub empowers financial organizations with a pre-built front-end to enhance the experience for their SMB customers. Centralize financial and operational data into a single, intuitive platform, empowering small businesses with real-time insights. By consolidating cash flow, expenses, and customer trends, it delivers automated visualizations and strategies to drive smarter decisions, enhance loyalty, and fuel growth, all accessible through your bank’s digital channels.

CUSTOMER INSIGHTS HUB

Know Your Customers, Grow Your Impact

The Customer Insights Hub equips financial organizations with actionable data to help strengthen their relationships with their SMB customers and optimize service offerings. Embedded in existing channels, the Insights Hub enables personalized services, proactive risk management, and optimized touch points, fostering stronger client relationships and strategic growth through actionable, portfolio-level clarity.

POWERFUL FEATURES

Discover the full range of exceptional functionalities

Elevate your customers' digital financial experience by harnessing the strength of actionable insights

WHY 9SPOKES FOR INDUSTRY LEADERS

Driving Insights and Innovation for SMBs

Seamless Brand Experience

Empower your business with a fully white-labeled platform that integrates seamlessly into your existing online presence, preserving your brand identity and digital vision.

Trusted, Enterprise-Grade Platform

Our platform scales effortlessly to serve major financial institutions like Bank of America, delivering proven reliability and expertise for your business.

Unmatched Data Security & Integrity

Achieve the highest standards of data security with ISO certification and direct API connections, eliminating screen scraping for guaranteed accuracy and integrity.

Fueling Rapid Digital Transformation

Our strategy focuses on creating a compelling working capital health proposition by seamlessly integrating solutions from multiple vendors, helping you stay ahead in a fiercely competitive market.

Meeting Evolving Customer Needs

Whether you seek integrated solutions or a Single Sign-On (SSO) platform, our proven capability empowers us to tailor and embed experiences that perfectly align with you and your customers.

Consented Data Connectivity

By bridging the data gap between SMBs and bank relationship managers, we enable deeper insights into customers' financial health, attracting new clients and enhancing relationships.

TESTIMONIALS

Unlocking Insights, Strengthening Relationships, Delivering Value

“The insight and data integration upgrades create incredible convenience for entrepreneurs to manage their businesses’ complete financial picture.”

Head of Small Business Banking

“The seamless data visualization and integration tools empower small businesses to make informed decisions with a clear, real-time view of their financial performance.”

Small Business Advisor

“The partnership we have signed with 9Spokes is merely the beginning of what we know will lead to enhanced experiences and benefits to our business customers.”

Group Business Director

Ready to Get Started?

Ready to take your financial institution to the next level?

Explore how 9Spokes can help you get the most from data insights and build better value and experiences for your customers.

Request a personalized demo to see how 9Spokes can help you achieve your business goals.