PLATFORM

A Data-Driven Solution Designed to Bridge the Gap Between Financial Organizations and Their SMB Customers

Empower your organization with seamless data integration, advanced analytics, and automated cashflow tools to drive better financial outcomes for you and your customers.

Discover the Power of 9Spokes

Get a firsthand look at how our intuitive platform enables financial organizations to empower their business customers through valuable insights and key metrics.

HOW IT WORKS

STEP 1

Integrate with 9Spokes

Financial Organizations embed 9Spokes into their digital product offerings offered to SMB customers.

STEP 2

Launch Product to SMBs

SMB customers securely link and sync their financial accounts, accounting and business data across various financial providers.

STEP 3

SMBs Access Actionable Insights

9Spokes ingests and aggregates data and delivers actionable insights to SMBs via embedded dashboard.

STEP 4

Improve Customer Relationships + ROI

Financial Organizations are provided with portfolio insights on SMB customers that enables delivery of more tailored services and appropriate products to SMB customers.

SMB FINANCIAL HUB

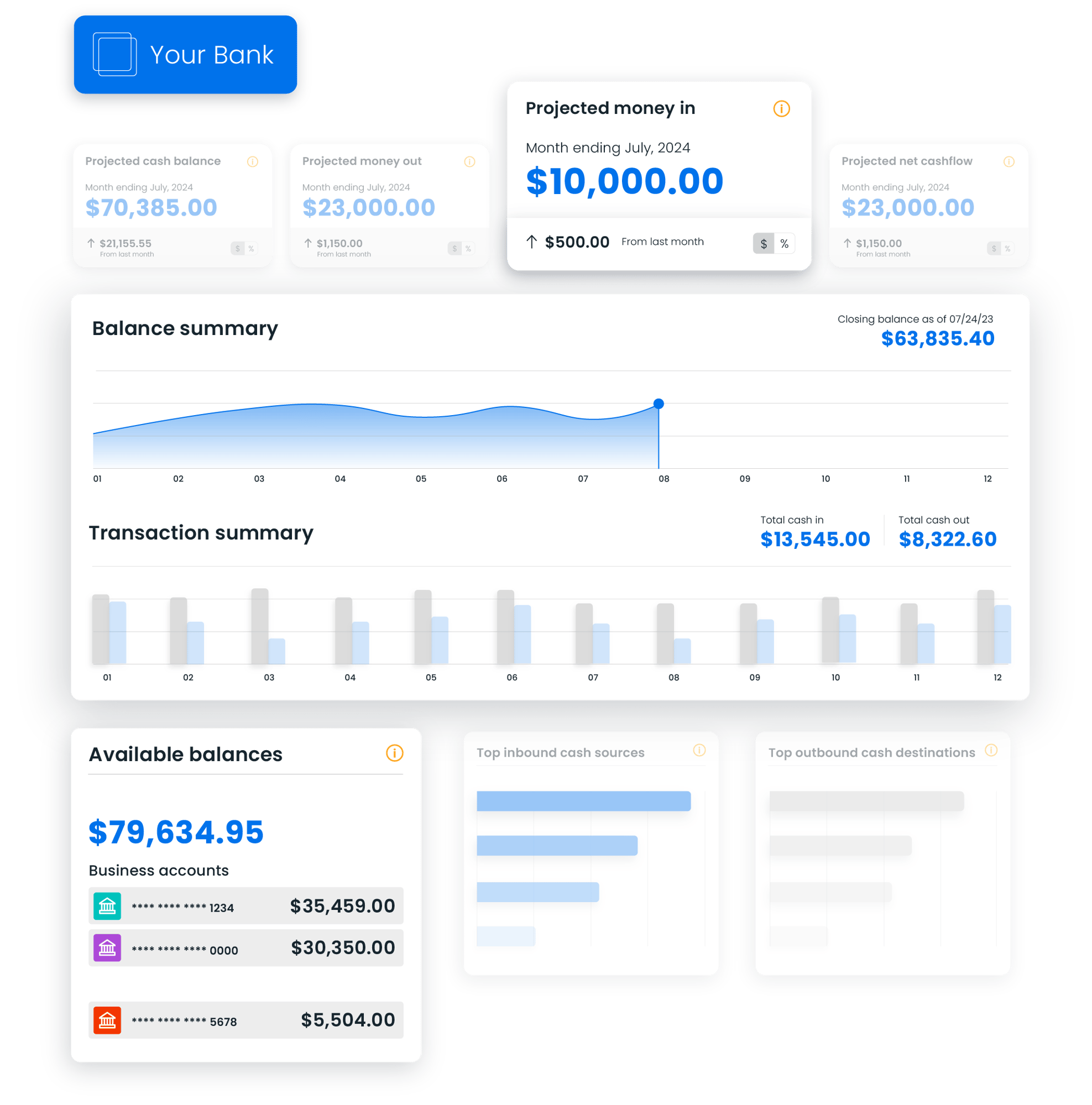

Empowering financial organizations with a pre-built front-end to enhance the experience for their SMB customers. This white-labeled dashboard helps SMBs improve their financial management abilities, fostering growth and efficiency through reliable, data-driven insights.

-

AGGREGATE FINANCIAL INSIGHTS: View cash balances across all connected accounts and understand current cash positions based on banking and general ledger data.

-

BUSINESS APP INTEGRATIONS: Consolidate key metrics from marketing, sales, social media, e-commerce, and more to gain holistic business insights in one place.

-

EFFICIENT CASHFLOW MANAGEMENT: Connect general ledger data via accounting applications to manage cash flow against budgets, visualize projections up to 90 days in advance, and automate forecasting for efficiency.

-

DETAILED TRANSACTION INSIGHTS: Drill down into transaction details to prevent duplicates and ensure accuracy, enhancing financial clarity and decision-making.

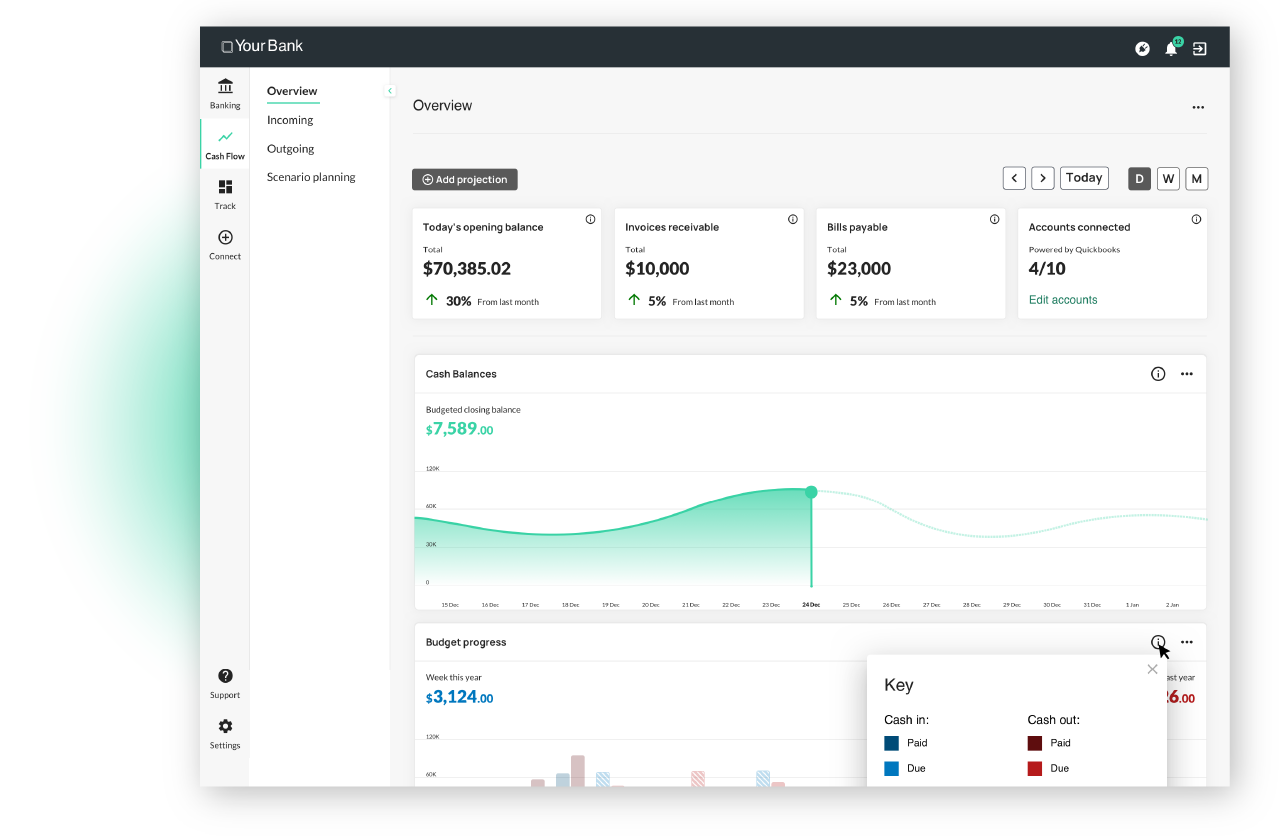

Cashflow

Help your customers to manage their cash flow by connecting their general ledger data. Small businesses can:

-

Understand current cash position based on banking and general ledger data.

-

See cashflow against a budget set.

-

View transactions impacting cashflow position.

-

Use Kanban or calendar view to change the due date for bills and invoice to evaluate the impact on cashflow position.

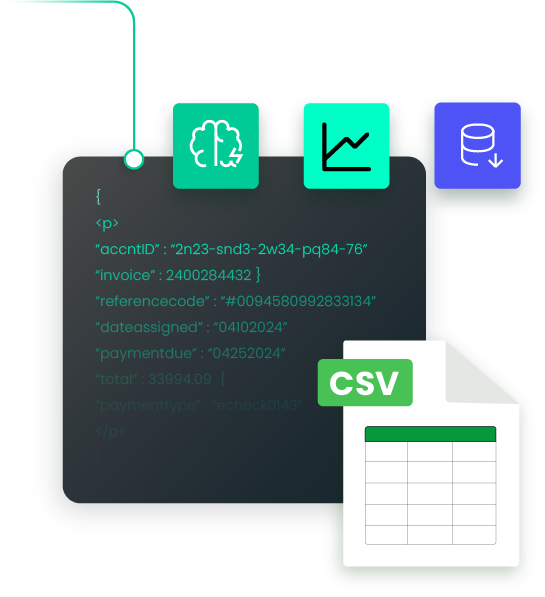

CUSTOMER INSIGHTS HUB

Financial organizations are equipped with actionable data to help strengthen their relationships with SMB customers and optimize service offerings. By providing detailed insights into SMB financial health and customer behaviors, our platform enables organizations to make informed decisions that drive business growth and enhance customer satisfaction.

-

FLEXIBLE DATA ACCESS: Portfolio insights on their SMB customers can be obtained via a direct API feed or CSV file downloads, ensuring seamless data accessibility and integration into existing systems.

-

COMPREHENSIVE CUSTOMER UNDERSTANDING: Gain deep insights into SMB financial health, preferences, spending behaviors, and competitive landscape to refine product offerings and marketing strategies.

-

SIMPLIFED ENGAGEMENT EVALUATION: Analyze user engagement and aggregated data across SMB activities to strategize upselling, cross-selling, loyalty programs, and personalized offers.

-

PLATFORM UTILIZATION METRICS: Access valuable metrics on platform usage throughout the customer journey, empowering digital leaders to redefine targeted strategies for different customer segments, industries, and regions.

READY TO GET STARTED?

We aim to empower businesses with secure, reliable data solutions that deliver essential insights and tools, driving growth and success for both them and their business customers. Contact our team to discover how 9Spokes can support your goals.